Wealth Management 2024

Balancing Hope and Opportunity

The year 2024 brought hope and challenges in global politics and financial markets. The US election dominated headlines, with debates focused on economic policies and geopolitical strategies. Tensions between China and Western nations remained high, with Taiwan continuing as a focal point. In Europe, the energy transition gathered pace. Investments in renewables and efforts to reduce reliance on imported energy drove significant progress. Meanwhile, the Global South rose as a powerful economic and political force, sparking regional cooperation and fostering innovation.

Financial Markets and Wealth Management in 2024

In financial markets, recovery unfolded steadily. Global equities posted moderate gains, with the S&P 500 climbing 10%. Technology and healthcare led growth, while energy and commodities faced pressure from shifting demand. Central banks kept interest rates stable as inflationary pressures eased. Cryptocurrencies regained momentum, with Bitcoin holding at $30,000 and Ethereum thriving thanks to advancements in decentralised finance (DeFi) and tokenisation. Institutional adoption of blockchain technology grew, transforming industries like real estate, supply chain, and payments.

Wealth Management: Innovation, Personalisation, and Growth

Wealth management embraced innovation and diversity in 2024. ESG investing gained clarity as regulations provided more straightforward guidelines. Investors prioritised sustainable growth. Portfolio diversification expanded to include private equity, infrastructure, and alternative assets, helping clients navigate uncertainty. Digital transformation led the way, with AI-driven tools offering real-time portfolio optimisation and improved client engagement.

Success in 2024 was shaped by adaptability and strategic foresight. To explore these themes further, browse my Wealth Management 2024 blogs, most of which were also published on LinkedIn.

Your Guide to Wealth Management in 2024

Taxonomy Cloud

Explore the Taxonomy Cloud

Dive into Wealth Management Blogs by Year

Click on the links below to uncover insightful articles, emerging trends, and thought-provoking updates from each year:- Wealth Management 2021 Blog

- Wealth Management 2022 Blog

- Wealth Management 2023 Blog

- Wealth Management 2024 Blog

- Wealth Management 2025 Blog

Quick Tip:

Looking for answers to common questions about independent wealth management? Don’t miss our Wealth Management FAQ page, where you will find straightforward explanations and insights on foundational concepts and strategies. With the Taxonomy Cloud, finding the content that aligns with your interests has never been more straightforward. So, why wait? Start exploring now and dive into the engaging categorised content waiting for you!Swiss Independent Wealth Management Blog

The Independent Wealth Management Advantage

Explore the world of independent wealth management in Switzerland, a sector often depicted ironically in movies as a place to hide money through numbered accounts, a relic of the past. However, it’s essential to note that the reality of Swiss wealth management is far more regulated and transparent today. Discover the facts behind this cinematic myth by visiting our VAPA Swiss Independent Wealth Management blog. We provide insightful and up-to-date information on this industry, shedding light on its modern practices and regulations. Don’t miss the chance to demystify the myths and explore the genuine world of wealth management in Switzerland.

independent wealth managers

Unlock your path to wealth management success! Independent managers focus on your needs, offering transparent, tailored strategies. With Swiss precision and open architecture, they provide expert guidance and diverse options. Start your financial journey today!

From Education to Independence

Kickstart your path to a successful banking career with our expert guide! From securing the right education and certifications to mastering networking and becoming an independent wealth manager, this roadmap equips you for professional growth and success in finance. Start your journey to excellence today!

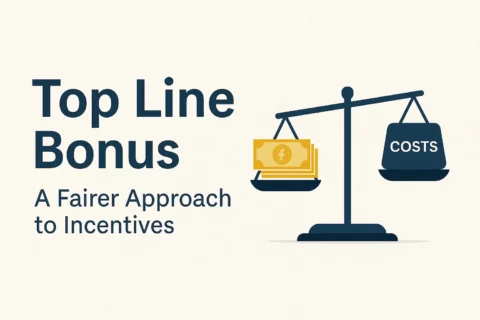

Compensation Models

Navigate the complexities of wealth management compensation with ease! Discover the stark contrasts between traditional banks and independent firms, and learn how transparent, performance-linked models enhance motivation, reduce stress, and align interests for both managers and clients. Experience a more transparent, fairer approach to wealth management today!

Personalised

Independent wealth managers prioritise personalised and adaptable strategies in managing clients' assets, focusing on building strong, long-lasting relationships. They stand apart with their entrepreneurial mindset, providing customised financial solutions that cater to the unique needs and goals of each client.

Pricing Myth

Independent wealth managers in Switzerland often surpass private banks in cost-effectiveness, offering transparent, client-focused fee structures. This approach contrasts with potential hidden fees and in-house product reliance at banks, thus providing superior overall financial value and tailored solutions.

The Vital Role of Custodian Banks

Custodian banks in Switzerland are crucial to the success of independent wealth managers. They offer more than asset protection; they provide essential services that support growth and innovation in the financial sector. These partnerships are crucial to maintaining Switzerland’s leading position in global finance. Discover more about the vital contributions of custodian banks on our VAPA Swiss Independent Wealth Management blog.

custodian Banks

Custodian banks in Switzerland ensure regulatory compliance and secure transaction processing. Their focus on operational transparency and asset protection sets them apart, making them vital to the stability and trust within the wealth management sector. This strategic role reinforces Switzerland's financial leadership.

Tri-Party Setup

A tri-party setup between the client, wealth manager, and custodian bank enhances transparency and efficiency. This structure ensures tailored services and secure asset management, reinforcing trust in Switzerland's financial sector.

Selecting the best custodian bank

Choosing the best custodian bank is vital in independent wealth management. It directly impacts client satisfaction. By aligning services with client goals and leveraging technology, you can provide tailored solutions. This strategic decision strengthens your role as a trusted advisor and ensures success in a competitive market.

Wealth Security Through Multibanking Strategy

Using multiple custodian banks is key in wealth management. Not only does it lower risk, but it also boosts financial stability. By spreading assets, you enhance security while optimising strategy. As a result, this approach strengthens client protection, increases flexibility, and ensures sustainable success.

The Power of Open Architecture in Wealth Management

Open platforms are vital to the success of independent wealth managers in Switzerland. They offer flexibility in product choices and drive growth and innovation in the financial sector. These platforms allow wealth managers to create tailored investment strategies that meet each client’s unique needs while ensuring transparency. Learn more about the benefits of open platforms for independent wealth managers on our VAPA Swiss Independent Wealth Management Blog.

Open Platform

For those exploring Swiss wealth management, the open platform approach offers crucial flexibility. By accessing various custodian banks and investment products, wealth managers can provide tailored solutions, ensuring each decision aligns with client goals while maintaining transparency.

Multibanking

For High Net Worth Individuals and Ultra High Net Worth Individuals, multibanking is essential in asset management, providing risk diversification, specialised expertise, and consolidated information for effective risk management. This approach not only enhances investment strategies but also ensures financial solutions and global market insights.

Open Architecture

for those exploring the swiss wealth management sector, it's imperative to have a clear understanding of their available investment universe. whether drawn to the structured offerings of proprietary architecture or the customised solutions of open architecture, their decision should mirror their financial narrative and ambitions.

Consolidated Reporting

For those navigating Swiss wealth management, a consolidated multi-banking view is crucial. Effective portfolio management systems should offer transparency and flexibility, ensuring comprehensive oversight while aligning with cross-border complexities and client growth strategies.

The Dynamic Lifestyle of a Wealth Manager

Wealth management comes with its share of stress, but seasoned professionals know how to balance the pressure. Indulging in luxury watches, high-end cars, and exclusive experiences, along with unwinding with industry-related books or movies, helps them manage the intense demands of the job. Discover on our VAPA Swiss Independent wealth management blog how wealth managers navigate stress and find moments of relaxation amidst their high-stakes careers.

Wealth Manager Lifestyle

Wealth managers thrive on balancing market challenges and client satisfaction. Upswings bring success, while downturns test their skills. Personal connections are key, blending work and social interactions. Leisure time is crucial to staying sharp in this high-pressure career.

Movies every Banker should Watch

Unlock the financial world's secrets through cinema! Whether you're unwinding after a long day or seeking inspiration, dive into our hand-picked selection of must-watch movies for every banker. from thrilling Wall Street dramas to eye-opening financial documentaries, these films offer a unique blend of entertainment and industry insights.

Top Watches for Swiss Wealth Managers

Choosing the right watch goes beyond style; it reflects your values and appreciation for craftsmanship. Which watch best represents your professional identity? Explore our top picks and find out. In Swiss wealth management, precision and attention to detail are paramount. Each of these eight watches has earned its place.

Money Matters: Entertaining Books

reading these books offers a delightful diversion in the fast-moving world of wealth management. thus, exploring these titles not only gives a much-needed break but also enhances your understanding of the diverse aspects of finance. ideal for both seasoned investors and those new to the field, these books are a delightful blend of Crime and finance.

Top-Tier Cars Favoured by Wealth Managers

In the Swiss finance sector, particularly for private bankers and wealth managers in Zurich, a car is far more than a mere transport means. It's a status symbol, meticulously chosen, especially when clients are out of sight. With Swiss clients, understatement rules

Luxury Champagnes for Wealth Managers

In wealth management, Champagne is far more than a drink. For wealth managers and bankers, it’s a symbol of achievement, chosen to reflect taste. With Swiss clients, elegance and understatement reign.