While revisiting a 15-year-old analysis I conducted on the preferred custodian banks of independent wealth managers (EAMs, FIMs), I was struck by how much – and how little – has changed. The original findings came from a PowerPoint buried deep in my archives. Curiosity got the better of me, and I decided to compare that data with today’s trends.

The results? Eye-opening.

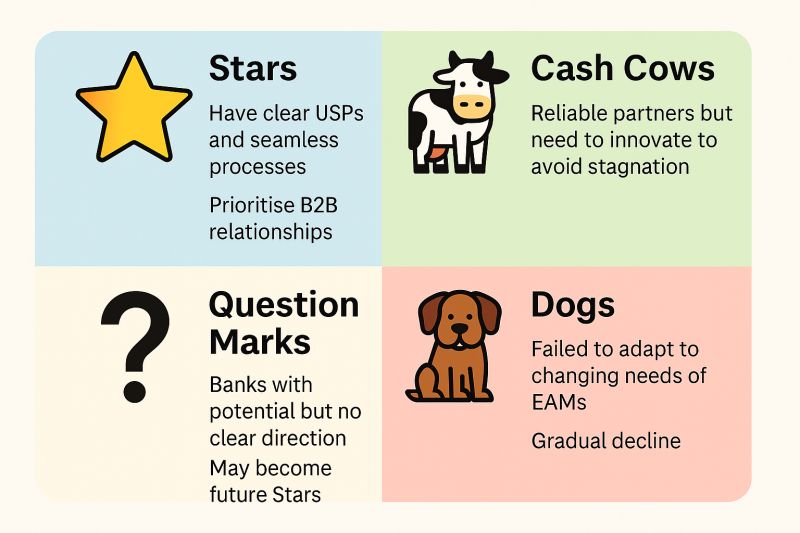

The evolution of custodian banks is rarely dramatic. It’s a gradual shift – challenging to spot in real time, but unmistakable when you compare the proper snapshots. Some banks rise, others plateau, and a few fade away. Here’s how I would characterise the current landscape:

🌟 Stars

These are the banks that consistently deliver. They combine strong USPs with seamless processes – making life easier for independent wealth managers. Stars prioritise B2B relationships and truly understand the needs of EAMs. It’s not about being small or niche – it’s about mindset, agility, and execution. That said, even Stars can stumble. I’ve seen banks fall from grace within just a few years, only to recover through decisive leadership and renewed focus.

🐄 Cash Cows

The dependable workhorses. These banks have been solid partners over time. But reliability alone doesn’t guarantee future success – innovation matters. If complexity creeps in, communication falters, or complacency sets in, even loyal clients may begin to look elsewhere.

❓ Question Marks

Banks with potential but lacking direction. They often have good intentions but fall short in execution or strategic clarity. With the proper focus and a commitment to what makes them different, some Question Marks could become tomorrow’s Stars.

🐕 Dogs

Banks that failed to adapt. They didn’t evolve with the changing expectations of independent wealth managers. As needs shifted, independent wealth managers moved on, leaving these banks behind.

The Big Picture

Stars must stay sharp to keep their edge. Cash Cows risk becoming Dogs unless they evolve. And Question Marks? With bold moves, they may still seize their moment.

Source: LinkedIn