In today’s compliance environment, a strong KYC (Know Your Customer) narrative is essential for every Relationship Manager. KYC sits at the heart of AML compliance, due diligence, and the client onboarding process. This guide explains the key KYC requirements —from Source of Wealth (SoW) to Source of Funds (SoF) —and links to a sample KYC template you can use.

Why KYC Narratives Matter

- Legal and regulatory fit: Clear documentation supports AML obligations and internal CDB/AMLA standards.

- Transparency: Compliance must understand the origin of funds and who ultimately owns them.

- Risk control: A concise, consistent KYC text streamlines reviews and reduces onboarding delays.

Key Elements of a Strong KYC Narrative

1) Personal Information

- Full name, date of birth, nationality, and tax residency.

- Family situation (if relevant), residential address and ownership status (owned/rented, mortgage).

- Identification method: passport copy and proof of address on file.

2) Professional Background

- Brief, chronological employment history before wealth creation.

- Include early savings or family guarantees only if documented.

- Avoid gaps; explain transitions clearly.

3) Source of Wealth (SoW)

Explain how the client built wealth over time. Typical components:

- Employment income and savings (e.g., salary statements).

- Business profits and retained earnings (e.g., audited accounts).

- Company sale proceeds (e.g., SPA and closing statement).

- Ownership evidence (e.g., share register/shareholder list).

Best practice: Cross-reference each material statement with an attachment to keep KYC requirements auditable.

4) Source of Funds (SoF)

Describe the specific inflow to your bank account:

- Who sends the money, from which account, on what date?

- Link SoF directly to SoW (e.g., partial transfer of sale proceeds).

- Evidence: bank statement or transfer confirmation.

5) Expected Activity

- How much will be invested (e.g., discretionary wealth preservation mandate)?

- How much remains for personal spending, and where?

- State if no cash transactions are expected.

6) Compliance Checks and Beneficial Ownership

- Record the results of PEP, sanctions, and adverse media screening.

- Mention counterparties where relevant (buyers, lenders) and their respective screening processes.

- State clearly the beneficial owner (UBO).

- Reference tax declarations to evidence tax compliance.

7) Conclusion

Close with one to two neutral sentences confirming that documentation is complete, that the SoW and SoF are consistent, and that the profile is transparent. Do not assign a risk class in the Relationship Manager narrative; that is Compliance’s role.

Best Practices for Relationship Managers

- Write short, factual sentences; avoid marketing language.

- Keep SoW and SoF in separate sections.

- Cross-reference all key claims with attachments.

- Include the share register if ownership matters; include the tax declaration if available.

- Think like Compliance: anticipate questions, avoid ambiguity.

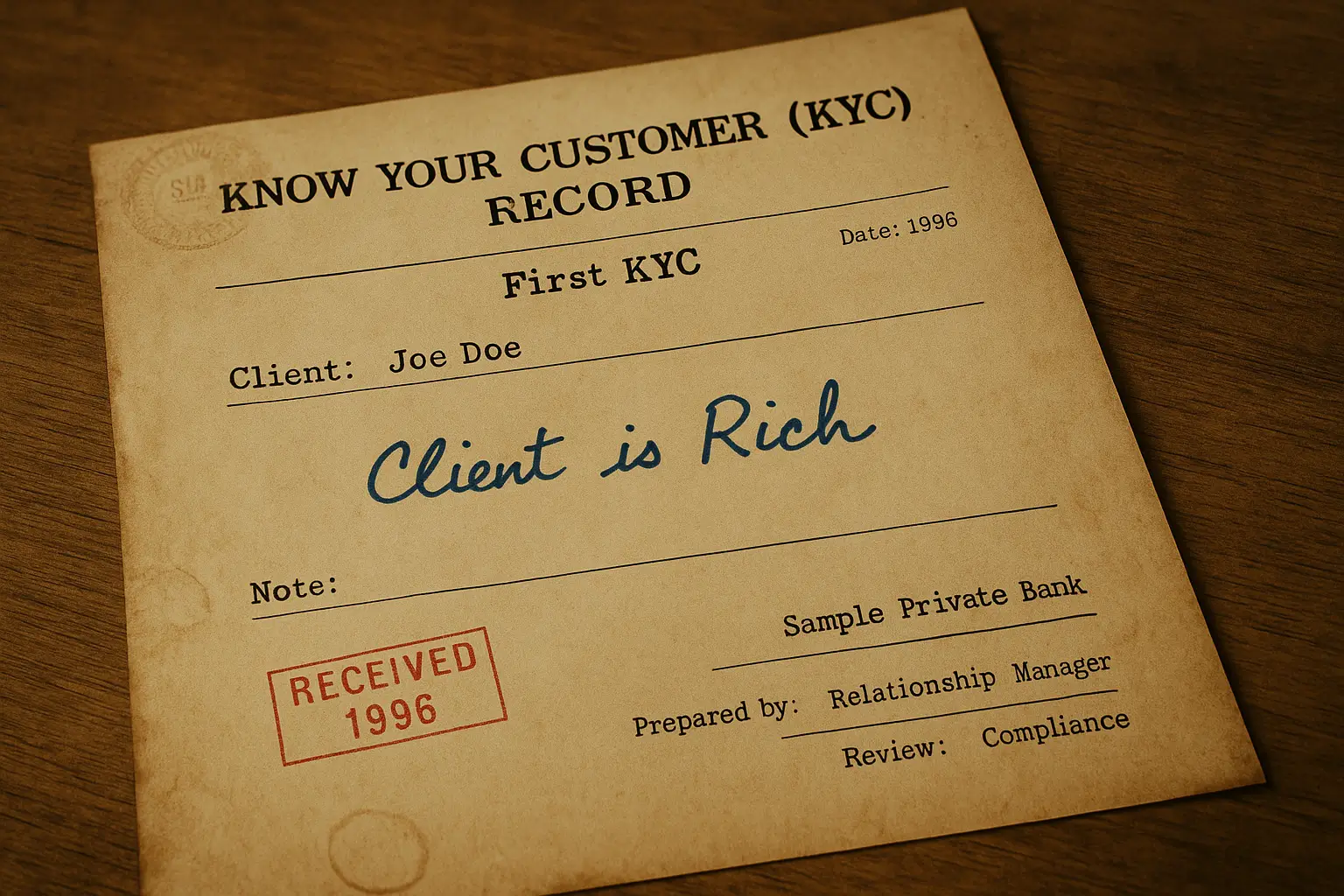

Sample KYC (Reference)

See the complete example here: Sample KYC Narrative – Mr Joe Doe. It presents a comprehensive KYC narrative, spanning from employment savings and business creation to a documented company sale, with attachments referenced step by step.

FAQ: KYC, AML and Onboarding

What is the difference between SoW and SoF?

Source of Wealth (SoW) explains how wealth was built over time (e.g., employment, business profits, sale proceeds). Source of Funds (SoF) describes the specific inflow coming into the bank for this relationship (e.g., a CHF 20m transfer from a retail account funded by a CHF 25m sale).

Should I include early savings?

Include them if documented and relevant to the client’s wealth story. If the amount is minor and not evidenced, omit to avoid unnecessary document requests.

Can the RM write the risk classification?

No. The RM prepares the narrative; Compliance assigns the formal risk class and acceptability.

Final Thoughts

A strong KYC narrative is not about length; it is about clarity, completeness and documentation. With a clear structure, proper attachments, and consistent SoW/SoF, even strict Compliance reviews proceed smoothly.