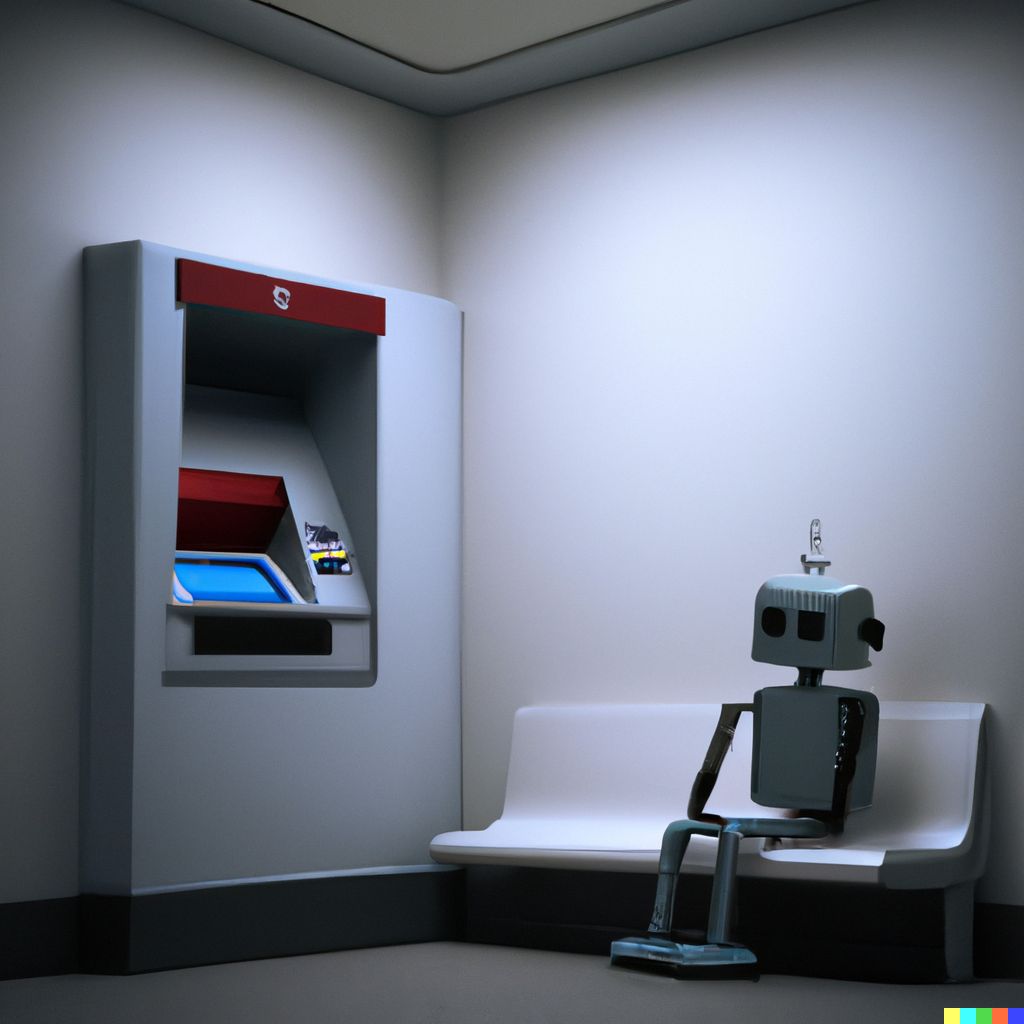

As artificial intelligence advances, GPT models will undoubtedly play an increasingly important role in the banking industry. These models can analyse large amounts of unstructured data and transform it into valuable insights, which can be used to automate processes and increase efficiency across a range of areas within banking.

One of the areas where GPT models can be particularly effective is the retail customer service department. By deploying chatbots powered by GPT models, banks can provide customers with faster and more accurate responses to their queries, helping to reduce waiting times and improve the overall customer experience.

Balancing High-Tech Analysis and Personal Service

GPT models excel in data analysis. They help banks identify patterns and navigating the future that might be missed otherwise. This ability allows banks to make better decisions and manage risks more effectively.

In lending, GPT models can assess a client’s creditworthiness. This helps banks manage loan portfolios better and reduce the risk of defaults. In trading and investment, these models analyze market and economic data. This aids banks in making informed investment decisions.

Despite their potential, GPT models cannot replace all aspects of wealth management. Personal service remains crucial, especially for high-net-worth individuals needing individualised attention. Additionally, banks must address security and privacy concerns. They need to use GPT models responsibly and sustainably in the long term.

Overall, using GPT models in wealth management represents an exciting opportunity for banks to increase efficiency, better manage risks, and provide a superior client experience. By deploying these models in targeted areas across the industry, banks can position themselves for navigating the future success in an increasingly competitive and rapidly evolving landscape.

Source: LinkedIn