Banks have logos, legacy systems and lengthy processes.

Independent wealth managers have… clients who stay. What Banks Could learn.

So, what’s going on?

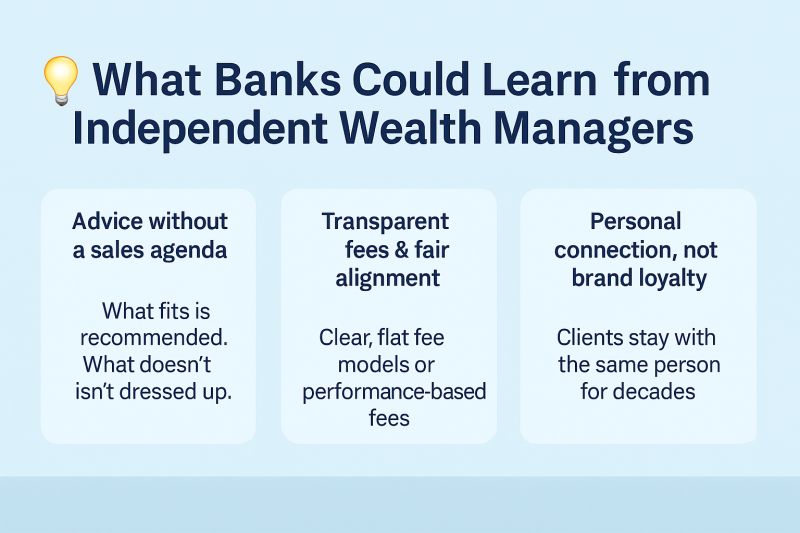

💬 1. Advice without a sales agenda

An independent manager doesn’t push in-house products; clients feel the difference.

What fits is recommended. What doesn’t isn’t dressed up.

📌 Advice ≠ sales. Clients notice.

💰 2. Transparent fees & fair alignment

No fine print. No, “we only earn on the structure”.

Many independents use precise, flat fee models or performance-based fees.

If the client wins, so does the manager. That’s absolute alignment.

📌 An all-in fee isn’t a fairy tale – it’s already happening.

👥 3. Personal connection, not brand loyalty

People build trust with people, not with brand slogans.

With an independent, the relationship manager doesn’t change every other year.

In many cases, it’s the same person for decades.

📌 Continuity isn’t a feature – it’s the foundation.

🟢 Final thought – What Banks could learn:

Banks aren’t worse. Just a bit… preoccupied with themselves.

Looking across the table at leaner, client-first firms could be refreshing.

Or, to put it with a smile – What Banks Could Learn:

💬 Sometimes the smaller players are the ones thinking the biggest.

Source: LinkedIn