In times of currency volatility, few developments carry as much weight as a weakening US dollar. For independent wealth managers in Switzerland, this trend has a long-term financial impact. It’s closely tied to global asset allocation, investor psychology, and multi-currency strategies.

Unlike large institutions that follow rigid allocation models, independent Swiss advisers build bespoke frameworks. A weakening dollar introduces both opportunity and risk. While dollar-denominated assets become cheaper for foreign investors, they also raise questions about inflation, purchasing power, and global confidence.

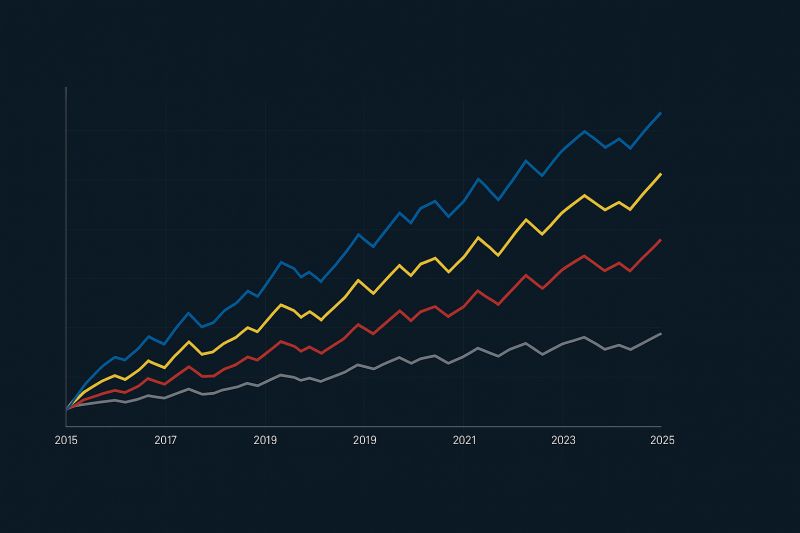

The chart above reflects multi-year portfolio trajectories across different currencies. All portfolios exhibit upward trends. However, those less exposed to USD volatility—especially the top lines—show smoother and firmer performance over time.

This insight matters. Swiss-based wealth managers are uniquely positioned, as they understand multi-currency portfolios, geopolitical shifts, and the nuances of cross-border asset management. As the dollar softens, their advice becomes not only relevant but strategic.

Clients with US-dollar exposure now face a fundamental choice: rebalance, hedge, or reallocate their assets. A generic portfolio model won’t cut it. Independent managers must adjust their positions, rethink currency risk, and anchor their decisions in long-term objectives, rather than succumbing to short-term panic.

Ultimately, the financial impact of a weak US dollar isn’t just a macro story—it’s deeply personal for globally invested families. The right wealth partner can turn this moment into a strategic inflexion point.

Because in currency moves—as in wealth—context is everything.

Source: LinkedIn