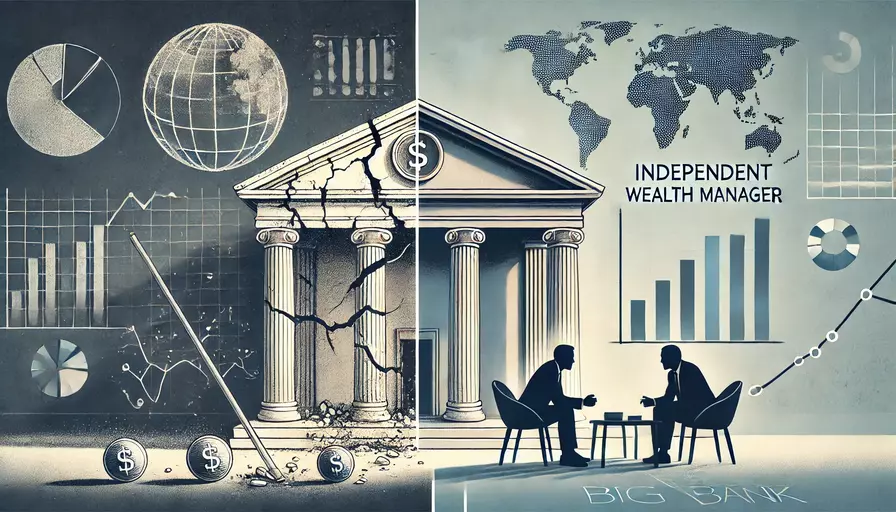

When managing wealth on a global scale, high-net-worth and Ultra-high-net-worth clients face unique challenges. Many turn to large institutions for their services, expecting stability and expertise. However, big banks often fall short, leaving clients frustrated and underserved. Independent wealth managers offer a more innovative, more client-focused alternative. Here’s what causes the hidden pitfalls of big banks.

Why Independent Wealth Managers Are the Smarter Choice

Flaws of Big Financial Institutions

Large institutions and private banks prioritise their profits, not your goals. They often push proprietary products that benefit the company rather than the client. This conflict of interest erodes trust and limits flexibility, a major hidden pitfall of big banks.

Big firm clients also face cookie-cutter solutions. Financial strategy providers often ignore individual goals and circumstances. This lack of personalisation can be costly for global clients with cross-border assets, unique tax situations, and varying risk appetites.

Additionally, large institutions are slow to adapt. Bureaucratic layers mean that clients may miss out when markets shift or opportunities arise.

Why Independent Wealth Managers Excel

Independent advisors are free from corporate quotas and product restrictions. They focus solely on their clients’ goals, offering unbiased, personalised solutions tailored to unique financial needs.

Independent wealth managers provide expertise in navigating cross-border tax laws, mitigating currency risks, and building globally diversified portfolios for international clients. This specialised knowledge ensures seamless financial management across jurisdictions.

Another key advantage is agility. Independent managers can respond quickly to market changes, ensuring clients are always ahead of the curve.

The Swiss Advantage

Switzerland is renowned for its financial expertise, discretion, and stability. Independent wealth managers based here leverage these qualities to deliver unmatched global service.

They understand the complexities of international finance and offer tailored solutions that large private banks often overlook. From optimising tax structures to protecting assets during volatile times, Swiss wealth managers are trusted advisors for high-net-worth clients.

Independent wealth managers are redefining the future of financial advisory. By addressing the flaws of big institutions and focusing on transparency, personalisation, and global expertise, they provide superior solutions for international clients. The choice is clear for those seeking a more innovative way to manage wealth.