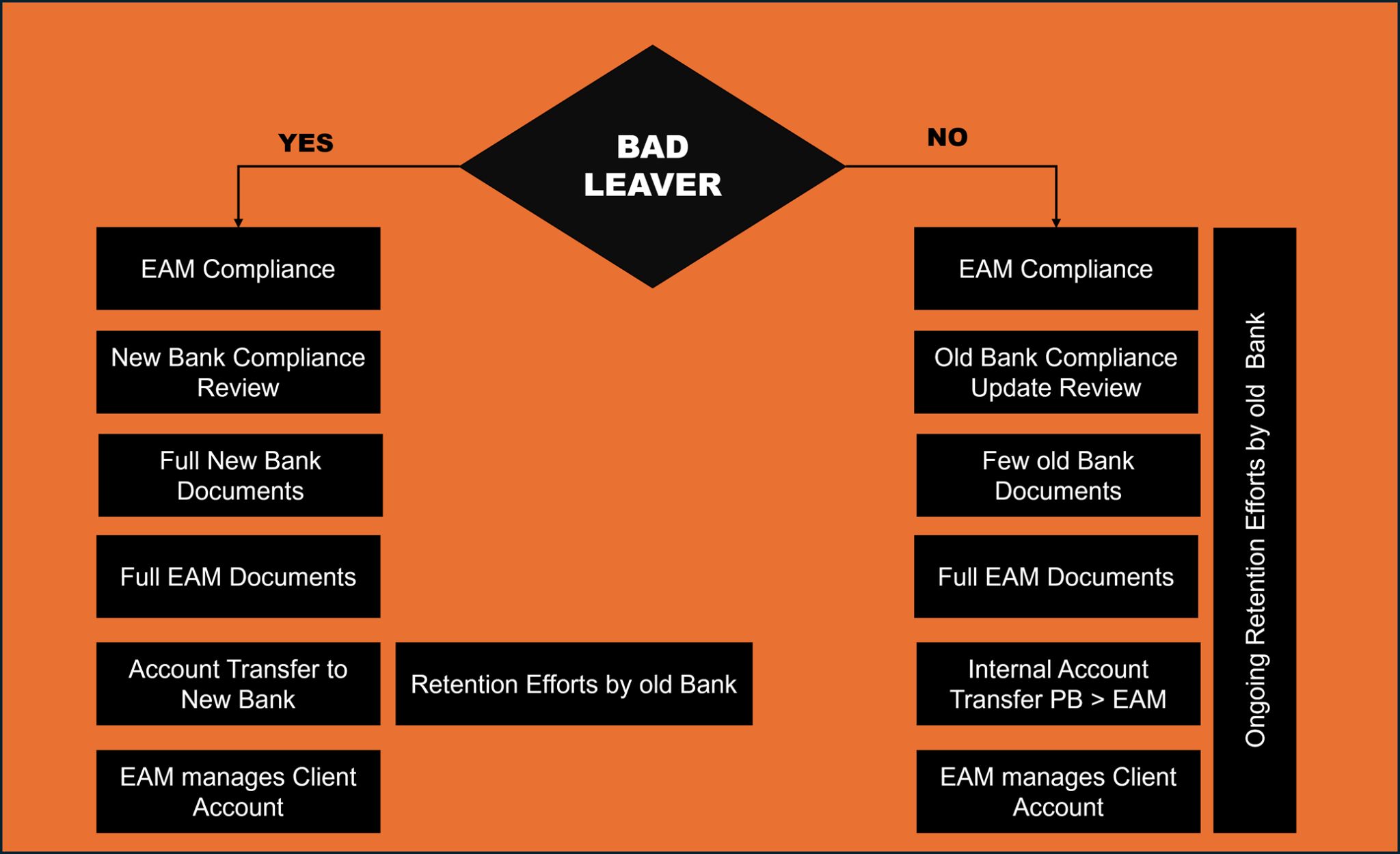

When a Private Banker leaves a bank to join an Independent Wealth Manager, the “Bad Leaver” clause often becomes relevant. Many banks apply this clause verbally, but they enforce it in practice. It blocks the banker from cooperating with the former institution for a defined period. As a result, both the banker and the bank must pause any direct interaction. Even if both sides want to continue the relationship, the rule prevents it. Therefore, the client cannot move directly from the Private Banking division to the same bank’s External Asset Manager (EAM) desk.

However, even though both sides may wish to continue the relationship, the restriction still applies and limits any immediate cooperation.

Yet even without such restrictions, the overall workload of a client transfer remains essentially the same. Every move to an Independent Wealth Manager triggers a full Know Your Customer (KYC) review — a detailed reassessment by compliance, risk, and legal teams. Each client relationship must be revalidated, with documentation, suitability, and risk assessments repeated in full.

The real difference lies in the client’s experience. When the custody account remains at the same bank, the process feels smoother: no new bank documents, no unfamiliar systems, and no need to adapt to new account statements or reporting formats. For the client, this continuity feels seamless — but behind the scenes, the operational and regulatory work continues to be considerable.

For the Independent Wealth Manager and the Relationship Manager, this continuity helps preserve trust and communication. But it does not eliminate the effort required to make the transition compliant and secure.

Ultimately, a “Bad Leaver” status is not the end of the world. It may cause some short-term inconvenience, but it can also mark the start of a new chapter. Building relationships on a clean slate often creates stronger, more sustainable foundations — especially when the old bank actively tries to pull clients back into Private Banking.

For those who’ve made the move — what was the most surprising part of the transition for you? Let’s share some real-life experiences.

Source: LinkedIn