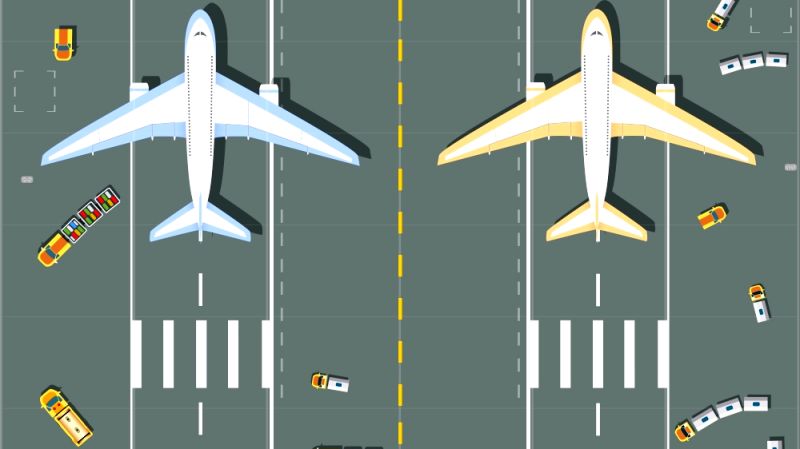

Anyone who has ever spent time at Zurich’s Kloten airport can’t help but observe the prominent presence of Swiss International Air Lines. Their aircraft, branding, and services are everywhere. Yet, amidst this dominance, there’s the ever-present hum of other global airlines, each bringing unique value, routes, and services to travellers. This vibrant scene at the airport offers a fascinating parallel to the wealth management landscape. 🛬🌐

Just as Swiss is the flagship carrier at Zurich Airport, many wealth managers are recognised for their flagship in-house products. These products are carefully designed with a focus on efficiency and cost-effectiveness. They embody the wealth manager’s perspective, strategies, and market insights. Trusted and highly regarded, these products are often the main reason clients choose a wealth manager. 🏦🧐

However, this is where the analogy truly stands out. Just as Zurich Airport isn’t solely defined by the Swiss, a skilled independent wealth manager understands the importance of diversification. They recognise that a portfolio enriched with external investment opportunities offers a more balanced, diversified approach, capturing a broader market potential range. 📊🌍

Why is this diversity so important? Diverse flight options give travellers more flexibility, better routes, and competitive pricing. In the same way, open architecture in investments allows investors to explore more options. They can use varied strategies and secure the best market position. 💹🤝

In conclusion, the next time you find yourself pausing to appreciate the intricate dance of aircraft at any airport, let it be a reminder: Diversity in our travel choices and investment strategies isn’t just a luxury—it’s essential. As we celebrate choices in our journeys, so should we in our financial endeavours. 🛫💼🌐🔑

Source: LinkedIn (SEO adjusted)