Rethinking Digital Silence in Swiss Wealth Management

Switzerland remains one of the most trusted destinations for private wealth, and rightly so. Stability, discretion and long-term thinking are deeply rooted in the DNA of independent wealth managers nationwide.

But in my view, and based on many conversations across the industry, many Swiss firms still have little or no digital presence, and some haven’t even started to think seriously about digital channels.

The digital gap I keep seeing

This goes far beyond outdated websites or inactive LinkedIn profiles. It reflects a broader mindset. For many, Digitales Wealth Management is still considered optional – something for others, or simply “not our style.”

But client expectations have changed. The first impression is increasingly digital, particularly for internationally minded and next-generation clients.

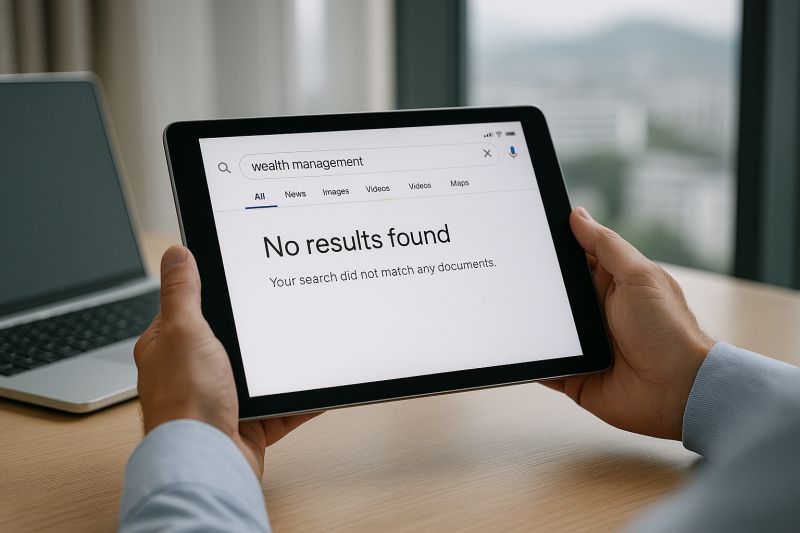

If you can’t be found, do you exist?

Let’s be honest: would you walk into a restaurant in Hong Kong without checking the website or reviews? Unless you already know the place or it has a world-class reputation, you’ll want digital reassurance – if only to be sure they don’t just serve bird’s nest soup.

Choosing a wealth manager isn’t so different. Without a clear digital presence—no team, no thinking, no identity—a firm risks seeming detached, no matter how competent it is.

Visibility supports trust

This isn’t about hype. It’s about showing professionalism. A well-crafted digital presence reinforces what we value most in Swiss wealth management: quality, continuity and substance.

Digital Wealth Management is not about replacing discretion. It’s about reflecting it in a way clients understand.

Your thoughts?

This is my observation. Curious to hear yours.

Is digital silence still a strength – or a quiet risk in a connected world?

Source: LinkedIn