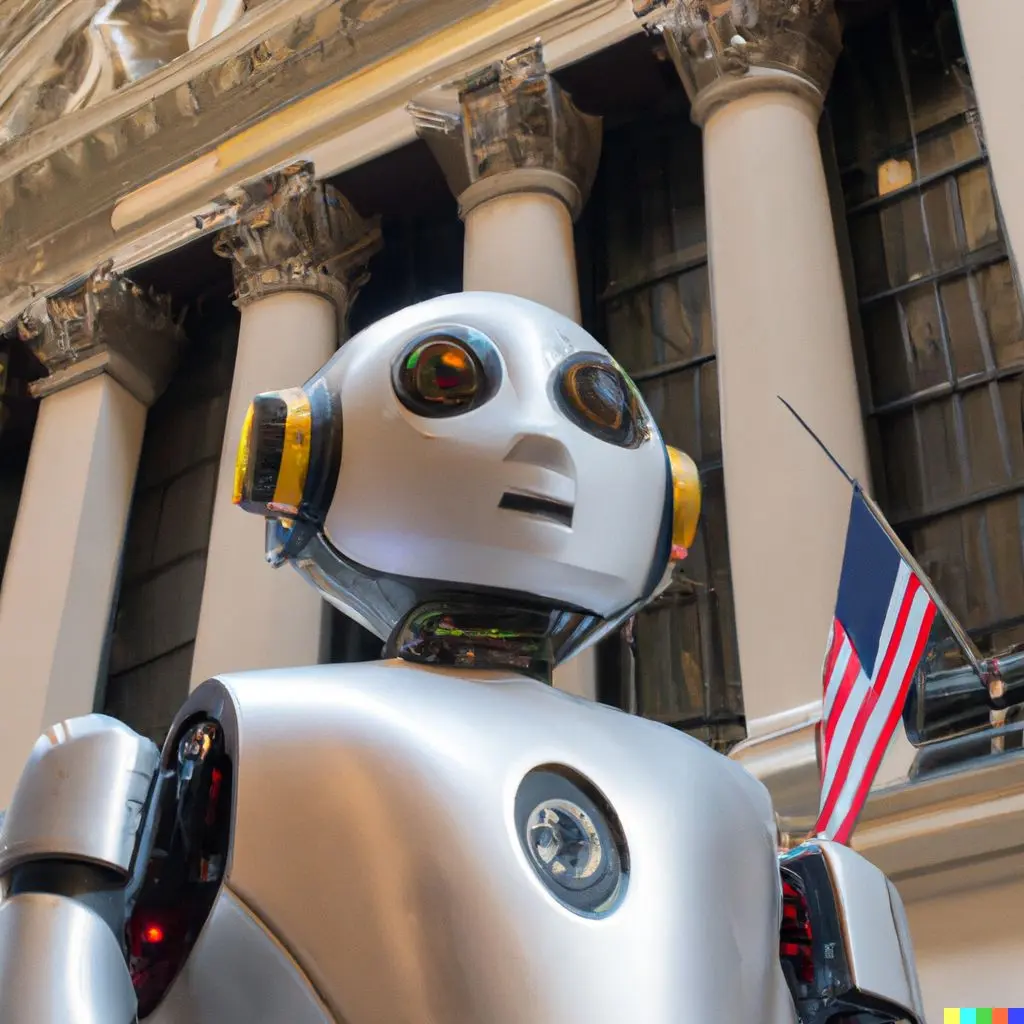

Imagine a world where financial markets pulse not to human intuition but to the cold precision of artificial intelligence. As AI tightens its grip on portfolio management, profound transformations unfold, reshaping investment strategies and market dynamics. This future promises efficiency and speed, fundamentally altering how we approach finance.

The efficiency of our markets could reach unparalleled levels. With its lightning-fast data processing, AI will quickly spot and exploit any price inefficiencies, leaving little room for classic arbitrage. But as these algorithms converge on similar investment strategies, a paradox emerges.

The diversification we’ve hailed as the cornerstone of risk management might diminish, ushering in an era where many portfolios mirror each other. This echo chamber of investment strategies has the potential to amplify market volatility, with synchronised AI-driven buy or sell decisions creating waves of herd behaviour.

In this landscape, the traditional allure of active management, steeped in human judgment, might recede into the shadows. Instead, an arms race of evolving AI models could dictate the pace, constantly recalibrating to secure that ever-elusive competitive edge.

Yet, every seismic shift brings counter-movements. Regulators might step in, curbing homogenization risks. Despite our love for technology, investor sentiment might return, yearning for a human touch and seeking solace in authentic, hand-crafted investment strategies. This balance could redefine the future of finance, blending innovation with tradition.

At this crossroads, one truth remains: finance and AI will rewrite the rules. However, in this brave new world, will human judgment be the missing piece to complete the puzzle, ensuring balance and stability in the financial markets?

Source: LinkedIn (SEO adjusted)